Decrease in Payables Cash Flow

Add or subtract the amount. If you therefore want to increase or decrease these balances you need to add the amount of the increase or decrease to the line with a matching description on the cash flow statement under the changes in operating assets section.

Statement Of Cash Flows Indirect Method Change In Accounts Payable Youtube

This means there is 2000 less cash in the business at the end of the period than at the start of the period.

. Positive cash flow means that more cash has come into your business than has gone out. Wells Fargos payables products help you streamline processes better manage expenses and improve information access. Therefore the company generated operating cash flow and free cash flow of 221 million and 93 million respectively during the year 2018.

CASH AND CASH EQUIVALENTS end of period 5034331 631214 SUPPLEMENTAL CASH FLOW INFORMATION. Calculate the change in working capital. Recommended actions that instantly address client needs and increase usage of the banks products and services.

Negative cash flow means that more cash has gone out of your business. Sum of rows BCD 125k. IAS 7 Statement of Cash Flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements.

Every business must record all its payables and receivables to measure the companys cash flows. Cash flow from investing activities for the quarter was an outflow of 62 billion. Remember cash doesnt mean revenue.

For each month you can see if you have positive or negative cash flow. A cash flow statement is a critical tool for analyzing the current liquidity of any business venture. Streamline your AP process reduce errors and fraud risk and decrease payment-processing time and cost when you convert from paper to electronic payables.

Balance of cash and cash equivalents at the start of the period. Cash can also come from financing activities. Subtract the latter from the former to create a final total for net working capital.

62 Other Current Liabilities and other similar items. Receivables partly offset by an increase in current payables. They are categorized as current.

Since the change in working capital is positive you add it back to Free Cash Flow. Decrease in trade payables-50000. Increase Decrease of Cash.

Cash Flow Formula Example 2. An investor notices that other current liabilities for Paushak Ltd have declined by 142 cr in FY2020 which is shown as a cash outflow in the CFO calculation. The more free cash flow a company has the more it can allocate to dividends.

Production decrease of 612 million post-tax. The company on the other hand upon depositing the cash with the bank records a decrease in its cash and a corresponding increase in its bank deposits an asset. At the end of the second quarter 2022 net debt was 464 billion compared with 485.

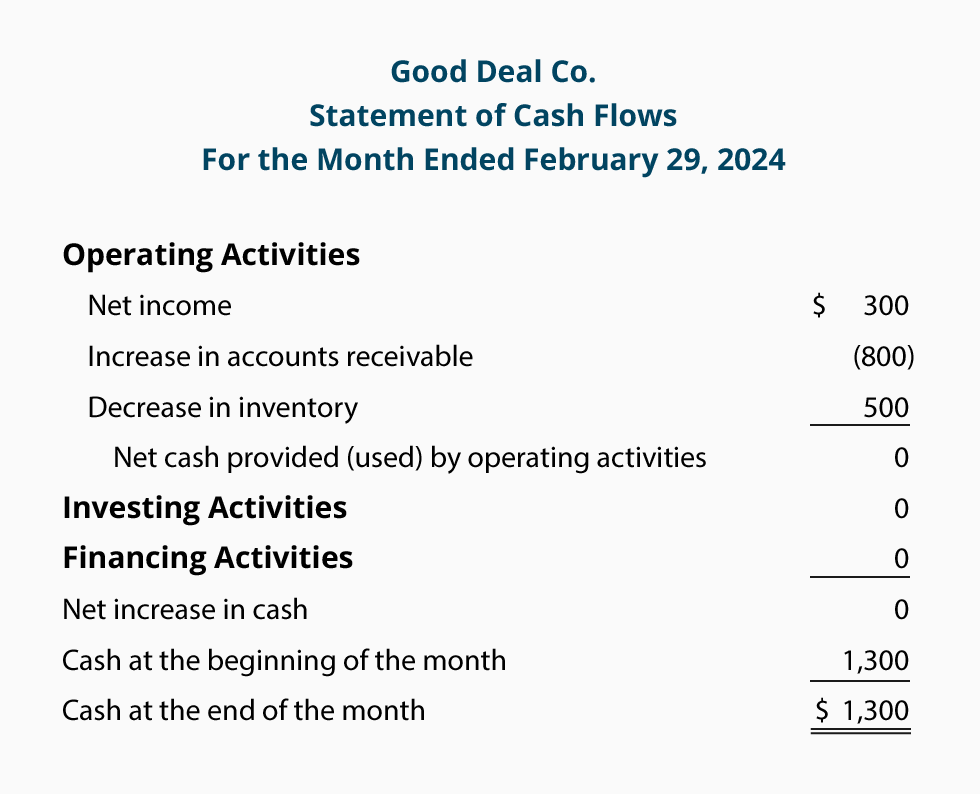

The three net cash amounts from the operating investing and financing activities are combined into the amount often described as net increase or decrease in cash during the year. This would mean that additional 5000 worth of debtors were not able to pay their dues which will decrease the cash available within the. Thats why the formula is written as - change in working capital.

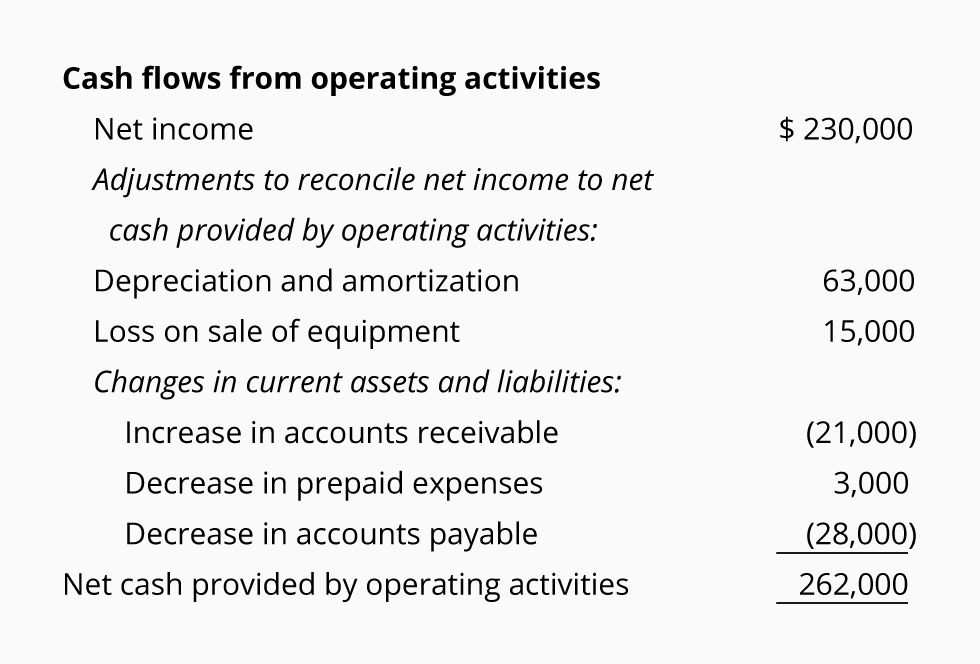

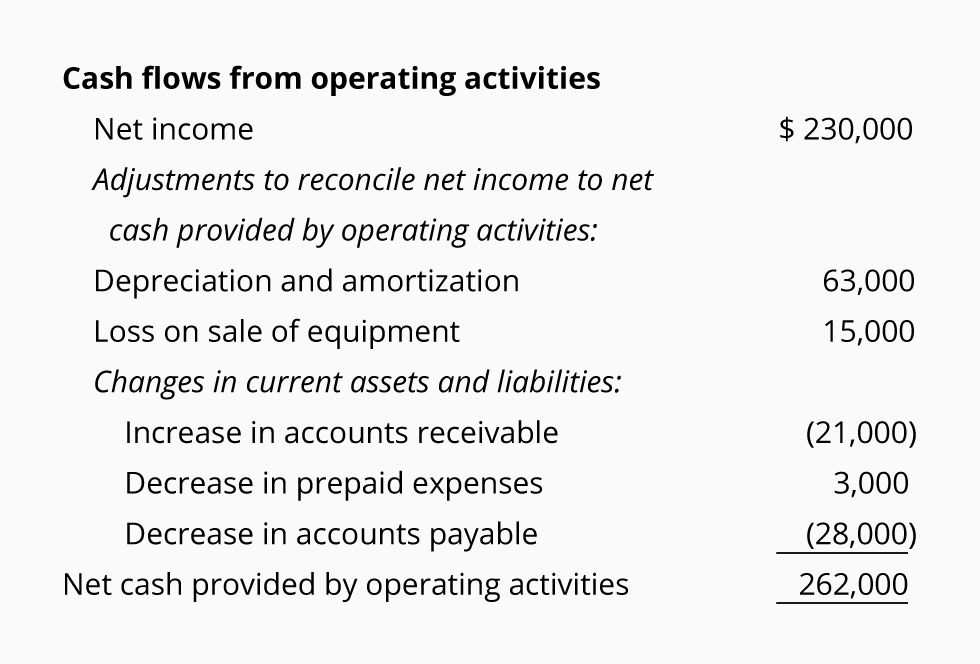

In Example Corporation the net increase in cash during the year is 92000 which is the sum of 262000 260000 90000. The goal is to. A credit either decreases an asset or increases a liability.

A decrease in payables is therefore an outflow of cash and should be deducted. If the following will be valuable create another line to calculate the increase or decrease of net working capital in the current period from the previous period. Previously required by FRS 1 revised 1996 Cash flow statements.

Increasedecrease in trade payables. Cash generated from operations. Net change to the balance of cash and cash equivalents for the period ie.

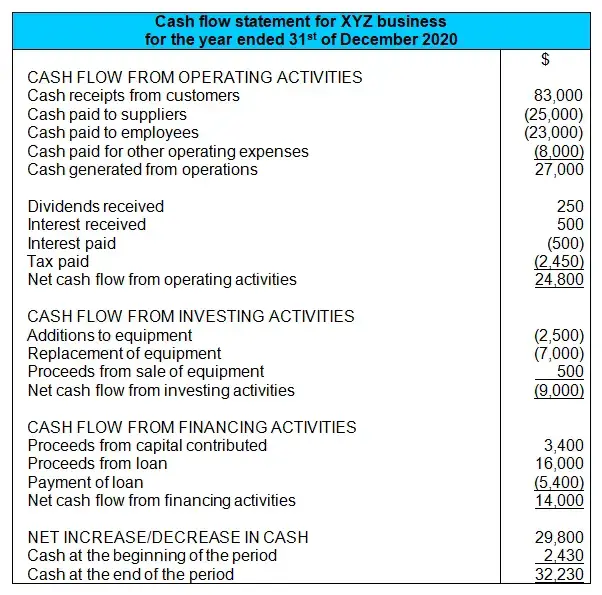

Operating cash flow is cash generated from the normal operating processes of a business and can be found in the cash flow statement. Cash flows are classified and presented into operating activities either using the direct or indirect method investing activities or financing activities with the latter two categories generally presented on a gross basis. Cash generated from operations.

It is unreasonable to issue a check for such small expenses and for managing the same custodians are appointed by the company. This information can be used to prepare a cash flow statement. The trade payables.

Net debt and Gearing. To illustrate the computation of the cash flow formula. Value of net income from Row A after the above adjustments 115k.

Investing cash flow 10k D. Read more checking account Checking Account A checking account is a bank account that allows multiple. Operating cash flow ie.

Create monthly cash flow projections with this unique cash flow projection template. Optimize your cash flow. The cash flow statement is the least important financial.

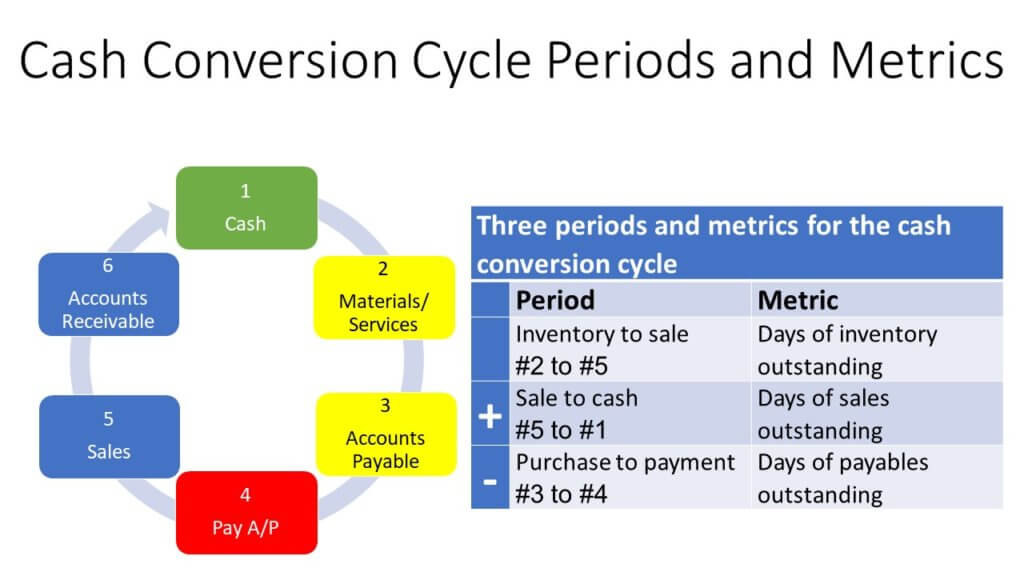

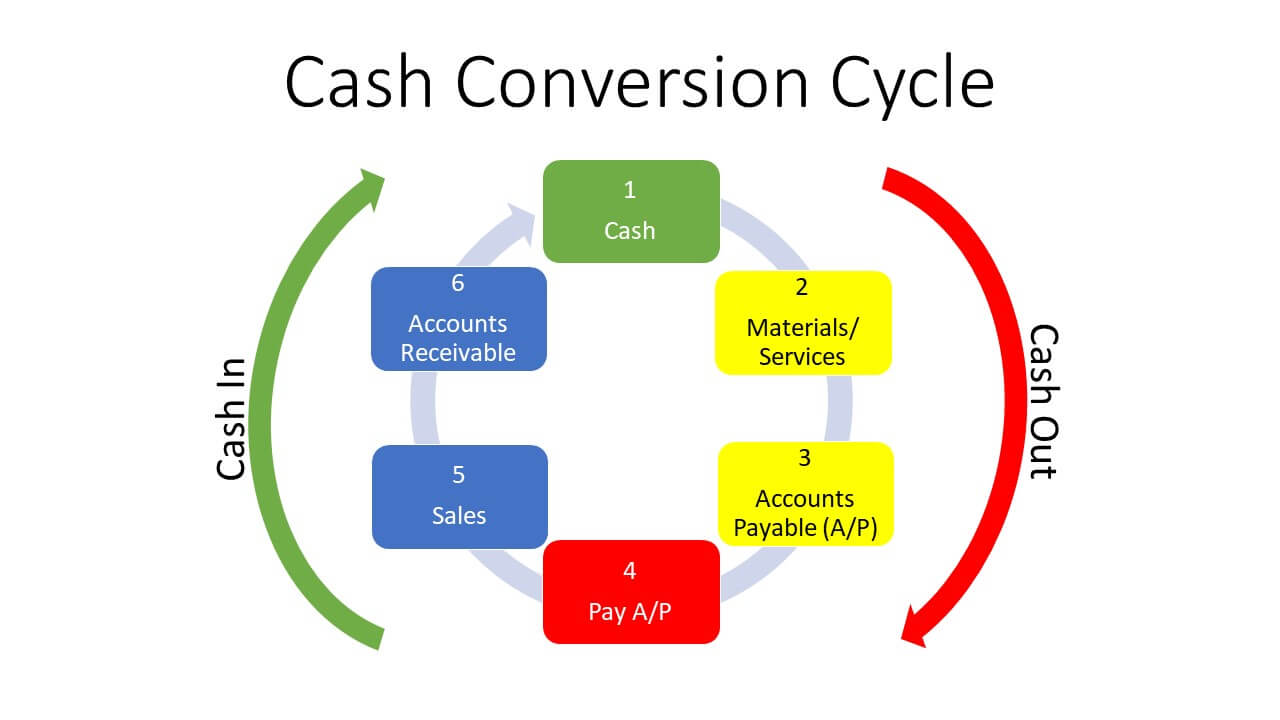

Cash comprises currency coins petty cash Petty Cash Petty cash means the small amount that is allocated for the purpose of day to day operations. Because if a decrease in trade payables is a cash outflow then an increase in trade payables is naturally a cash inflow. The receivables and payables lines include multiple balance sheet items which have been consolidated into a single line for cash flow statement purposes.

Purchase of fixed assets. Recommended offers that initiate cross-selling existing or new products and services. Loss on Sale of Property.

Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures. This can be done by deducting the closing payables balance from the opening payables balance and deducting the decrease. Debits and credits edit A debit either increases an asset or decreases a liability.

Accounts receivables are part of Cash In vs accounts payable which equates to Cash Out. First half 2022 segment earnings. Cash paid for income tax 133009 32003 Cash paid for interest expense net of capitalized.

Cash flows from investing activities. A cash flow statement can be compared to the reporting entitys income statement to see how well reported profits compare to cash flows. Decrease in Accounts Receivables Accounts Receivables Accounts receivables is the money owed to a business by clients for which the business has given services or delivered a product but has not yet collected payment.

The increase in accounts receivables is deducted from Net Profit and the decrease in accounts receivables is added to Net. FRS 102 FACTSHEET 3 ILLUSTRATIVE STATEMENT OF CASH FLOWS. Financing cash flow.

This analysis does not need to be presented for prior periods. Real-time modeling of what-if scenarios and alerts to manage forecasts. Cash Management predicts and automates enterprise-wide cash flows through.

There may be a substantial difference between the two. Increasedecrease in trade payables 234 Cash from operations 6889 Income taxes paid 2922 Net cash from operating activities 3967. Create subtotals for total non-cash current assets and total non-debt current liabilities.

Let us take the example of Walmart Inc. ABC Company Statement of Cash Flows direct method for the year ended 123120X1. When this happens we deduct any decrease in payables from the operating profit before tax.

Determine whether the cash flow will increase or decrease based on the needs of the business. Details In US Price per share. According to the annual report for 2018 the following information is.

Change in trade payables during the period from the balance sheet. The cash payment to creditors accounts payables or suppliers of material and.

The Short Cash Cycle How To Cut Crunches And Grab More Growth

The Short Cash Cycle How To Cut Crunches And Grab More Growth

Cash Flow Statement January February Transactions Accountingcoach

Cash Flow Statement Explanation Accountingcoach

Cash Flow Statement How To Calculate The Net Increase Or Decrease In Cash

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

Cash Flow Statement What It Is And Examples

0 Response to "Decrease in Payables Cash Flow"

Post a Comment